- 1843

- 0

Sharing Ideas and Updates on LPG in Nigeria and related information to enable effective collaboration within the LPG Value Chain

LPG Supply Chain Instability In Nigeria: Why We Keep Experiencing Scarcity And How To Fix It

Liquefied Petroleum Gas (LPG), popularly known as cooking gas, has become a household essential for millions of Nigerians. Yet, despite the country’s status as a major gas producer, the domestic LPG market remains highly unstable. In recent months, Nigerians have faced price spikes, product shortages, inconsistent deliveries, and terminal congestion, all of which reveal deep systemic issues within the supply chain. This blog examines the root causes of recurring LPG scarcity in Nigeria, from refinery disruptions to off-taker behaviour, and proposes industry-backed solutions for long-term stability.

✅ 1. Why LPG Shortages Keep Recurring in Nigeria

Nigeria’s LPG scarcity is not caused by a single factor, it is the result of interconnected weaknesses across production, distribution, funding, and market regulation.

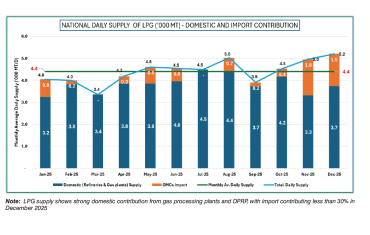

1.1 Dangote Refinery Shutdowns & Production Gaps

The Dangote Refinery, now a major player in Nigeria’s energy landscape, has had multiple operational interruptions, including the temporary shutdown of its fluid catalytic cracking unit (FCCU) in September 2025.

These shutdowns reduce the domestic supply of LPG and other refined products. Since the refinery is expected to play a dominant role in the market, any disruption creates:

Supply gaps

Increased import pressure

Speculative pricing

Distribution delays

Although operations later resumed, the refinery’s inconsistency remains one of the triggers for temporary LPG shortages.

1.2 NLNG’s Limited Domestic Supply

Nigeria LNG (NLNG) remains the single largest supplier of LPG to the domestic market. However, its supply is limited due to:

Existing long-term export contracts

Production fluctuations

Feedgas supply constraints

Plant maintenance cycles

According to NLNG, only about 450,000–500,000 metric tonnes of LPG is supplied annually to Nigeria, far below national demand that now exceeds 1.5 million MT.

This structural supply deficit means imports are inevitable, and whenever foreign markets tighten or forex becomes unstable, scarcity follows.

1.3 Terminal Congestion & Infrastructure Bottlenecks

Many LPG terminals in Lagos lack the storage capacity, truck-loading capacity, and dredging depth to handle rising demand.

Key bottlenecks include:

Limited jetty access

Inadequate storage tanks

Slow truck-loading operations

Long vessel turnaround times

Operational downtimes at Apapa and Kirikiri terminals

When vessels cannot berth or discharge on time, the entire downstream market feels the pressure.

✅ 2. Market Behaviours That Worsen Scarcity

Beyond infrastructure problems, human behaviour within the supply chain contributes significantly to price spikes and shortages.

2.1 Off-Taker Hoarding & Speculative Buying

When prices begin to rise, off-takers, plant owners, terminal operators, and distributors tend to engage in:

Bulk buying and hoarding

Holding stock to wait for higher market prices

Delayed selling as a form of speculation

This behaviour amplifies scarcity and leads to artificial price surges, a pattern repeatedly observed in Nigeria’s LPG market.

2.2 Price Markups at Each Distribution Stage

Because LPG moves through several layers:

Importers / producers

Terminal operators

Bridging and trucking companies

LPG plants

Retailers

Each level adds margins, which become even higher during scarcity. When terminal prices jump, retail prices follow instantly.

2.3 Forex Pressures and Import Dependence

Despite being gas-rich, Nigeria still imports over 60% of its LPG. Because these imports are priced in dollars:

Forex shortages

Naira devaluation

High exchange premiums

All translate into higher LPG retail prices even when there is no real supply shortage.

✅ 3. Why This Matters Now

Households and businesses across Nigeria are experiencing:

Severe price increases (₦1,000–₦2,500 per kg depending on location)

Plant shutdowns due to stockouts

Long queues at filling stations

Supply uncertainty for industrial users

Given Nigeria’s push for clean cooking and the health risks of biomass LPG scarcity undermines national and global sustainability goals.

✅ 4. How to Stabilise Nigeria’s LPG Supply Chain: Industry-Backed Solutions

4.1 Expand Domestic Production

Nigeria must reduce reliance on imports. This requires:

Increased NLNG domestic allocation

Accelerated Dangote refinery optimisation

Incentives for other modular refineries to produce LPG

A more diversified production base will reduce vulnerability.

4.2 Upgrade LPG Storage & Terminal Infrastructure

Government and private sector should invest in:

Larger coastal storage terminals (5,000–20,000 MT tanks)

Additional loading bays for trucks

Modern jetties capable of handling multiple vessels

Fast-loading digitalised systems

Improved infrastructure reduces congestion and supply delays.

4.3 Implement the Cylinder Recirculation Model (CRM) Nationwide

CRM has been successful in Côte d’Ivoire, Ghana, and India.

Benefits include:

Reduced accidents

Increased safety compliance

Faster turnaround of filled cylinders

Encouraged investment in cylinders by marketers

Nigeria has attempted CRM before but must now implement it fully.

4.4 Establish a Predictable Pricing Framework

Rather than letting market speculation drive prices, Nigeria needs:

Transparent price monitoring

A price-calculation template guided by PPPRA/Downstream Commission

Publication of weekly terminal prices

Anti-hoarding regulations

Predictability encourages stability.

4.5 Improve Transportation & Logistics

Investments needed include:

LPG trucks with GPS tracking

Pipeline-based transport (long-term)

Dedicated coastal shuttle vessels

Transport efficiency affects final retail price.

4.6 Leverage Government Policies & Subsidies

Subsidies do not need to be blanket they can be targeted:

Subsidise cylinder acquisition for low-income households

Tax waivers on LPG equipment

Reduced tariffs on imported LPG until domestic supply stabilises

Côte d’Ivoire's 50% LPG cylinder subsidy model is a notable success story.

✅ Conclusion

LPG scarcity in Nigeria is the result of systemic supply chain weaknesses from production shortfalls to terminal inefficiencies, speculative behaviours, and infrastructural gaps. While Dangote Refinery and NLNG remain key players, long-term stability requires coordinated action, including:

Infrastructure upgrades

Predictable pricing

Transparent supply allocation

Government-backed reforms

Increased domestic production

As Nigeria pushes toward clean energy adoption, stabilising the LPG supply chain is not optional, it is critical for national health, economic well-being, and sustainable development.

0 Comment.