- 13

- 0

Sharing Ideas and Updates on LPG in Nigeria and related information to enable effective collaboration within the LPG Value Chain

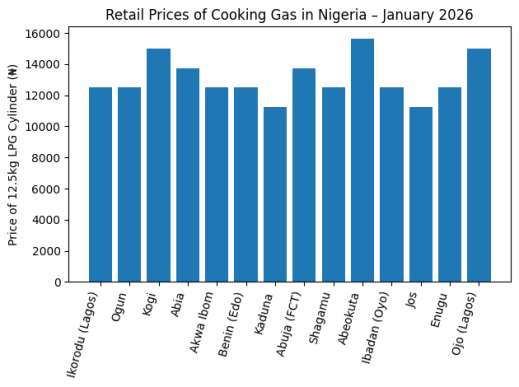

Retail Prices Of Cooking Gas In Nigeria For January 2026 Averaged ₦13,080.36

A Market-Level Price Analysis and Interpretation

1. Overview of the January 2026 LPG Market

The retail prices of Liquefied Petroleum Gas (LPG) across selected Nigerian cities in January 2026 reveal a market that is uneven, location-sensitive, and structurally influenced by logistics rather than scarcity. Despite Nigeria’s growing domestic gas ambitions, retail LPG pricing continues to reflect long-standing infrastructural, geographic, and distribution challenges. Across the surveyed locations, the average retail cost of a 12.5kg cylinder stands at ₦13,080.36, translating to an approximate national average of ₦1,046 per kilogram. While this average suggests relative price stability, a closer look shows significant intra-regional variation, with price differences of over ₦4,000 for the same 12.5kg cylinder depending on location.

This price spread highlights a critical reality: where Nigerians live still determines how affordable clean cooking energy is.

2. Price Distribution and Key Observations

Lowest-Price Locations

The lowest LPG retail prices in January 2026 were recorded in:

Kaduna – ₦900/kg (₦11,250 per 12.5kg)

Jos – ₦900/kg (₦11,250 per 12.5kg)

These prices are notably below the national average, suggesting:

Proximity to inland LPG supply routes

Competitive local retail markets

Possibly lower retail margins to sustain demand

Northern cities such as Kaduna and Jos continue to demonstrate that lower LPG prices are achievable, even outside coastal regions, when logistics and distribution chains function efficiently.

Mid-Range and Most Common Price Band

The most frequent retail price observed across the dataset is:

₦1,000/kg (₦12,500 per 12.5kg)

This price point was recorded in:

Lagos (Ikorodu – Ijede)

Ogun State (general)

Akwa Ibom

Edo (Benin City)

Shagamu (Ogun State)

Oyo (Ibadan)

Enugu

This clustering around ₦12,500 suggests an informal national benchmark price, likely influenced by:

Transport costs from coastal depots

Stable supply volumes

Strong retail competition in semi-urban and urban centres

From a consumer perspective, this band represents the most affordable and predictable LPG pricing environment in the country.

Higher-Price Locations

The highest retail prices were recorded in:

Abeokuta – ₦1,250/kg (₦15,625 per 12.5kg)

Kogi – ₦1,200/kg (₦15,000 per 12.5kg)

Ojo, Lagos State – ₦1,200/kg (₦15,000 per 12.5kg)

These prices sit well above the national average, and their occurrence in both inland and coastal-adjacent areas is telling.

Key drivers likely include:

Higher last-mile transportation costs

Fewer retail refill points

Localised supply constraints

Higher operating costs passed on to consumers

Notably, Ojo’s higher price despite being in Lagos State highlights an important truth: state-level location alone does not guarantee affordability — proximity to functional LPG infrastructure does.

3. Regional Pricing Patterns

South-West Nigeria

Prices in the South-West range widely:

₦12,500 in Ikorodu, Shagamu, Ibadan

₦15,625 in Abeokuta

₦15,000 in Ojo

This spread within the same region underscores infrastructure imbalance, not demand pressure. Areas closer to major depots and with denser retail networks enjoy lower prices, while locations with weaker distribution chains pay a premium.

South-East and South-South

Abia: ₦13,750

Enugu: ₦12,500

Akwa Ibom: ₦12,500

These prices suggest moderate stability, but still reflect dependency on transported LPG rather than strong local supply hubs. Any disruption in logistics or forex exposure could quickly push prices upward.

North-Central and North

Kogi: ₦15,000

Abuja: ₦13,750

Kaduna & Jos: ₦11,250

The contrast here is striking. While Abuja and Kogi face higher prices due to transport and storage constraints, Kaduna and Jos demonstrate that regional affordability is achievable with better supply alignment.

4. What the Average Price Really Tells Us

The ₦13,080 average price masks the lived reality of LPG consumers. For households earning daily or weekly income, a difference of ₦3,000–₦4,000 per refill is significant. It can determine whether LPG is used consistently or abandoned in favour of firewood or charcoal.

This reinforces a critical point:

Energy affordability in Nigeria is not national; it is local.

5. Implications for Households, Policy, and the LPG Market

For Households

LPG remains cheaper and cleaner in the long run

However, high refill prices in some locations discourage sustained adoption

Price volatility undermines trust in LPG as a “reliable” fuel

For Policymakers

Pricing disparities reflect infrastructure gaps, not fuel scarcity

Domestic LPG utilisation goals will remain aspirational unless:

Storage capacity expands inland

Transportation costs are reduced

Cylinder access models improve

For LPG Marketers and Investors

Underserved high-price locations represent market opportunities

Expanding retail networks can stabilise prices and grow demand

Long-term growth depends on affordability, not just availability

Conclusion: Price Stability Is the Real Clean Cooking Enabler

January 2026 LPG retail prices show that Nigeria is close to affordability, but not consistently there yet. The presence of ₦11,250 refill prices alongside ₦15,625 prices in the same month proves that lower prices are possible but not evenly distributed. If Nigeria’s clean cooking ambitions and Gas Master Plan objectives are to succeed, price stability and geographic equity must become priorities. LPG adoption does not fail because Nigerians resist change. It fails when clean energy becomes unpredictable or inaccessible. In the end, the success of LPG in Nigeria will not be measured by national averages, but by whether households, regardless of location, can refill a cylinder without hesitation.

0 Comment.